Introduction

Owning a car remains a key milestone for many Americans, but the rising price of vehicles has made auto loans the primary method of purchase. In 2025, the car-finance landscape in the United States is changing rapidly as banks, credit unions, and online lenders compete to offer flexible, technology-driven loan options. Whether you are purchasing your first car or refinancing an existing loan, understanding the latest trends can save you thousands of dollars.

What Is an Auto Loan?

An auto loan is a secured form of credit used to buy a new or used vehicle. The lender pays the dealership directly, and the borrower repays the amount in monthly installments with interest. The vehicle acts as collateral until the loan is fully paid.

Auto loans in 2025 typically run from 36 to 84 months, depending on the borrower’s credit profile, income, and vehicle type. A good credit score (above 700) still offers the best interest rates, but new digital lenders are now approving applicants with alternative credit data and faster online verification.

Major Types of Auto Loans in 2025

- New Car Loans – Offered by banks and manufacturer-affiliated lenders such as Ford Credit or Toyota Financial. They feature lower interest rates and promotional deals.

- Used Car Loans – Slightly higher rates, but flexible repayment options. Ideal for buyers choosing certified pre-owned vehicles.

- Refinance Loans – Allow existing borrowers to replace a high-interest loan with a cheaper one. Many online lenders specialize in refinance deals.

- Leasing to Own – Combines short-term leasing with an option to buy after two to three years; popular for electric vehicles.

Best Banks and Online Lenders (2025)

- Bank of America Auto Loans – Fixed APRs starting around 5.9% for excellent credit and convenient online pre-approval.

- LightStream (a SunTrust Bank division) – Known for no-fee personal and auto loans with same-day funding.

- Capital One Auto Finance – User-friendly digital process and tools for prequalification without impacting credit score.

- USAA and Navy Federal Credit Union – Offer lower-than-average rates for military personnel and family members.

- Carvana & Autopay – Online platforms that combine car search, financing, and delivery in one experience.

Factors Affecting Your Interest Rate

- Credit Score – The most important factor; higher scores mean lower APRs.

- Down Payment – Larger down payments reduce total loan cost.

- Loan Term – Shorter terms often carry lower interest.

- Vehicle Age – Newer cars usually qualify for better rates.

- Debt-to-Income Ratio – Lenders assess your monthly debt relative to income before approval.

Tips to Secure the Best Auto Loan in 2025

- Check Your Credit Report: Review and correct errors before applying.

- Get Pre-Approved: It strengthens your negotiation position at the dealership.

- Compare Multiple Lenders: Use online aggregators to see real-time offers.

- Avoid Long Terms Over 72 Months: They may reduce monthly payments but increase total interest.

- Consider Refinancing: If rates drop or your credit improves, refinance to save money.

- Shop During Year-End Sales: Dealers often provide promotional rates to clear inventory.

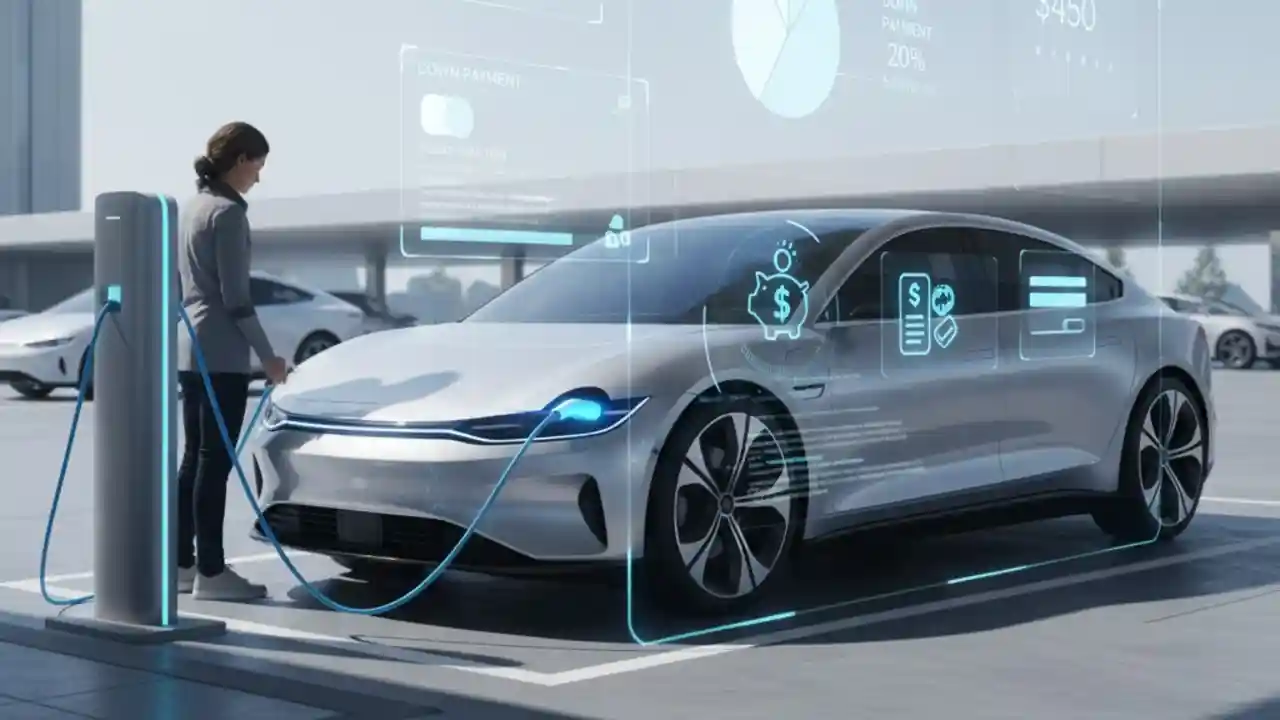

Future Trends: EV and Green Auto Loans

The U.S. shift toward electric vehicles (EVs) is creating new green-loan programs with tax benefits and lower rates. Many banks now partner with automakers to finance EVs and home charging installations together. By 2025, federal incentives and eco-friendly financing options are expected to expand, making sustainable driving more affordable.

Conclusion

Auto financing in the USA has entered a smarter, more digital era. With mobile apps, online approvals, and data-driven interest calculations, getting a car loan is faster than ever. However, success still depends on informed decision-making—comparing lenders, checking your credit, and choosing terms that fit your budget. By planning carefully, you can drive home your dream car in 2025 without overspending on interest.